President Donald J. Trump Fights for Higher Wages for Hardworking Americans — ANALYSIS

After seeing President Trump's "read more" tweet about how American households will take home $4,000 to $9,000 more a year, we were intrigued and clicked on the link (45.wh.gov/MXFfP9) provided. That took us to a White House "For Immediate Release" document put out by the Office of the Press Secretary. We felt it important to review in detail.

We analyze highlighted passages following the article.

The tax relief and tax cuts supported by President Trump will boost wages for hardworking Americans. Read more: https://t.co/w14k5lvftk pic.twitter.com/hkgtVGAAgY

— The White House (@WhiteHouse) October 21, 2017President Donald J. Trump Fights for Higher Wages for Hardworking Americans

“Lower taxes on American business means higher wages for American workers, and it means more products made right here in the USA.” – President Donald J. Trump

PAY RAISE FOR AMERICANS: The tax relief and tax cuts supported by President Donald J. Trump will boost wages for hardworking Americans.

- The average American household income could increase between $4,000 and $9,000 a year in wages and salary alone by cutting the Federal corporate income tax rate from 35 percent to 20 percent, according to an 1analysis by the Council of Economic Advisors (CEA).

- Wages and corporate profits used to grow at nearly the same rate, but that is no longer the case. In the last eight years, wage growth has stagnated while corporate profits increased by an average of 11 percent per year, according to an analysis by the CEA.

INVESTING IN AMERICAN JOBS: The Unified Framework for Fixing Our Broken Tax Code supported by President Trump will 5end the “offshoring model” as companies will bring profits back and invest in American workers.

- In 2016, 6a Federal corporate tax rate of 20 percent could have brought more than $140 billion in corporate profits back to America, according to an analysis by the CEA.

- Those profits could have helped boost the incomes of U.S. households.

- Our current uncompetitive corporate tax rate encourages U.S. firms to keep profits offshore.

- Last year, more than 70 percent of foreign profits earned by U.S. firms were kept offshore, up from 42 percent in 1984, according to an analysis by the CEA.

- Companies hold an estimated $2.8 trillion in earnings offshore, according to Audit Analytics.

- Cutting corporate tax rates will encourage firms to invest back in the United States, creating well-paying jobs for hardworking Americans.

- 8After President Bush’s 2003 tax cuts, the economy created 7.8 million jobs over five years, based on data from the Bureau of Labor Statistics.

- 9After President Reagan’s 1981 tax cuts, the economy created 14.8 million jobs over five years based on data from the Bureau of Labor Statistics.

- 10After President Kennedy’s tax cuts, the economy created 12.0 million new jobs over five years based on data from the Bureau of Labor Statistics.

TAX CUTS AND TAX RELIEF: The Unified Framework supported by President Trump will mean 11hardworking Americans can keep more of their money.

- Double the standard deduction so that more income is taxed at zero percent.

- The first $12,000 of income for individuals and $24,000 for married couples will be income tax-free.

- Lower individual income tax rates to: 12 percent, 25 percent, and 35 percent.

- Increase the Child Tax Credit and expand it to benefit more middle-income families and eliminate the marriage penalty.

- Create a new $500 tax credit for those caring for an adult dependent or elderly loved one.

The Council of Economic Advisors is appointed by and reports to the President. The Council generally has three members with one designated as its chair. President Trump has appointed only one member to date, Kevin Hassett, a conservative economist who believes in discredited supply-side ("trickle-down") economics. That trickle-down does not create sustained growth is the reason that David Stockman, President Reagan's budget director and architect of Reaganomics, is now among the most vocal opponents of the economic policies he once championed. Stockman has even branded trickle-down as "immoral." The CEA "council" analysis is one economist projecting positive results based on economic dogma.

The only positive is that Hassett believes immigration plays a positive role in driving economic expansion. However, that perspective is not reflected anywhere in the administration's anti-immigrant policies or agenda.

This contention assumes that

- wages in other countries work the same way as they do in the U.S., and

- that wage increases in other countries are actually tied to lower corporate tax rates as a primary causative factor.

These are baseless assumptions. For example, while wages and unemployment are largely independent of each other in the U.S. and France, they are closely linked in Canada, Germany, Japan, and Great Britain. More generally, wages in Europe don't move in the same cycles as in the U.S.. There is no legitimate basis to contend there is a causative link between corporate tax rates and wages.1

There is no statistical evidence indicating that cutting corporate tax rates spurs additional economic growth.2

Hassett himself proves that increasing corporate profits has no bearing on wages. Profits, after all, are what is left after taxes. So, if corporate profits are up 11% per year and nothing has gone to workers, it's simply illogical to conclude that even larger profits will suddenly trickle down to increase wages. Also, adjusting for inflation, today's average hourly U.S. wage is no higher than it was four decades ago3, disproving Hassett's contention that wage stagnation is a more recent phenomenon. (Technically, both wages and inflation have "stagnated.")

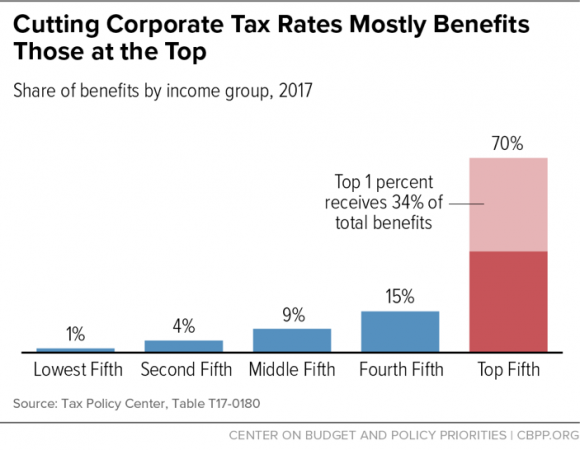

So, who do corporate tax rate cuts benefit?

Corporate tax cuts benefit the wealthy4

Corporate tax cuts benefit the wealthy4Answer = not hourly wage workers. We would add this is an earlier analysis, reviews of the budget passed by Congress (October 26th) put as much as 80% of cuts going to benefit the top 1%.

Simple logic disproves the basic contention that lower corporate rates will not only (1) repatriate profits, but that those profits will (2) generate jobs and (3) higher wages.

- repatriation of profits — Tax cuts to repatriate profits has been tried, and failed. In 2004, the Congress enacted a tax holiday for US multinationals to allow them to repatriate foreign profits to the United States at a 5.25% tax rate. Corporations brought $362 billion back into the American economy, however, those funds went not to growth or wage increases but to pay dividends to dividends to shareholders, repurchasing stock, and buying other companies. The largest US companies repatriated only 9% of their offshore profits. There is no incentive to repatriate at any rate since tax payments can be deferred as long as the profits remain "offshore" — held by foreign subsidiaries but often invested domestically back in the US. If a 5¼ percent tax rate failed to generate repatriation of a significant portion of profits, 20% certainly won't. Lastly, the entire issue of repatriation is a red herring because the administration is looking toward "territorial" taxation, meaning, multinationals would pay no U.S. income tax whatsoever on profits earned abroad.

- (repatriated) increased profits generate jobs — There is no basis for this contention. Using 2004 again as an example, "the 15 companies that benefited the most from a 2004 tax break for the return of their overseas profits cut more than 20,000 net jobs."5

- (repatriated) increased profits generate higher wages — This very report disproves the contention that increased profits feed higher wages.

The pertinent "CEA analysis" passage:

Firms’ tendency to engage in profit shifting is highly responsive to tax rate differentials. Hines and Rice (1994), using aggregate country-level data from the Bureau of Economic Analysis, estimate a tax semi-elasticity of profit shifting of -2.25, indicating that a 1 percentage point increase in the statutory home corporate tax rate results in 2.25 percent higher profit shifting to lower-tax jurisdictions. Applying Hines and Rice’s (1994) findings to a statutory corporate rate reduction of 15 percentage points (from 35 to 20 percent) suggests that reduced profit shifting would result in more than $140 billion of repatriated profit based on 2016 numbers.

But, buried in his own footnote to this passage, Hassett notes that more recent analyses point to a "semi-elasticity" of only 0.8, making that $140 billion more like $50 million. It's telling that Hassett resorts to a quarter-century-old analysis to make his case. Multinationals have since become far more skilled in tax avoidance. There's no basis to assume corporations will repatriate when they are now executing corporate inversions to move their headquarters out of the U.S.

The actual average rate paid by American corporations versus German, for example, is only a 3% difference. Once the discussion moves to actual taxes paid, the discrepancies become far less significant.

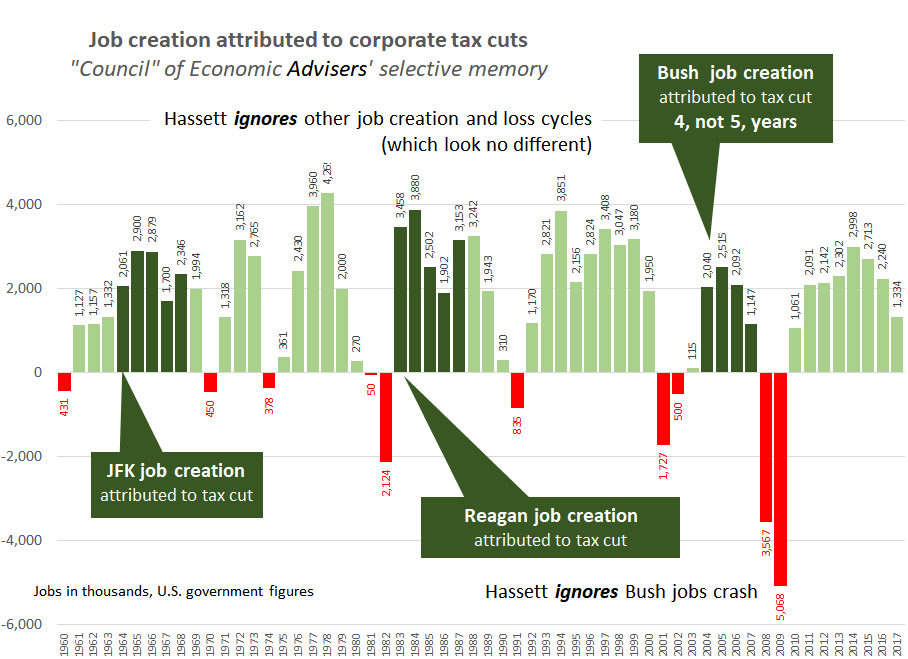

Hassett omits that the Bush/Republican economic policies crashed the economy. The U.S. lost 3.6 million jobs in Bush's last year and 5.0 million into Obama's first term, a net loss of 840,000 jobs. And Hassett gets it wrong — job creation only lasted four years.

One could also argue that falling oil prices created jobs as energy costs were reduced. Hassett omits that the U.S. went from being the world's largest lender to the world's largest debtor.

Hassett quotes a five year number for post-tax-cut job creation, but the fact is there's no magic five year benefit egg to be hatched. JFK's job creation lasted 6 years, Reagan's 7 years, while — and Hassett is sloppy here — Bush's last only 4 years before the bottom fell out. Hassett represents the worst in using statistics to artificially advance policy. The CEA was created to offer the President neutral and objective policy guidance, not to act as a propaganda arm of the administration. Results are always positive if you only count positive results.

In the grand scheme of economies running in cycles, job creation was already slowly on the rise. As with all corporate tax cuts, one can argue as to their efficacy in generating jobs. Moreover, it is disingenuous for Hassett to cite Kennedy as a justification for tax cuts in 2017. The highest marginal tax rate back then was 91%, Kennedy reduced that to 70%. That rate is 39.6% today. There's only so much one can cut until there is nothing left to cut. Crediting corporate tax cuts for Kennedy's job creation is also misleading in that Kennedy's economic policy also featured:

- increasing the minimum wage from $1.15 to $1.25/hour — no intent to do so in 2017, $1.25 in 1963 is equivalent to $9.93 today,

- expanding unemployment benefits — Republicans let extended benefits expire during the Obama administration,

- boosting Social Security benefits to encourage workers to retire earlier — the Congress has been raiding Social Security funding for years, all talk now is of retiring later, and

- spending more for highway construction — the administration's proposed program mainly privatizes roadways through incentives and tax breaks and does not directly invest in America's crumbling infrastructure.

Working Americans will not be better off in any significant way, if at all, following the Trump/Republican tax cut. We've already worked through an analysis that shows single parents — certainly our hardest working Americans with the most responsibility for the welfare of others — and their families will suffer economically under the administration's anticipated tax plan.

CEA's Hassett cites only data that fits, invents "five-year" benefit, and ignores the cyclical nature of economies

CEA's Hassett cites only data that fits, invents "five-year" benefit, and ignores the cyclical nature of economiesHassett's analysis is telling in terms of significant omissions, that is, he ignores positive cycles of job creation which he can't match up with corporate tax cuts.

- The economy generated 12.6 million jobs in four years, 1976–1979, during the Ford and Carter administrations. Unfortunately, job creation dwindled to 270,000 in Carter's last year. That paved the way for Reagan(omics) and the institutionalizing of supply-side economics as political dogma.

- 15.5 million jobs were created under the Obama administation, which rescued the auto industry over the objections of many Republicans, and pursued tax policies aimed at benefiting workers and small businesses — not multinational corporations, which by Hassett's own admission have been growing at 11% per year.

The reality is that:

- economies run in cycles — they always have, always will,

- corporate tax cuts do not increase hourly wages,

- corporate tax cuts do not generate jobs,

- corporate tax cuts do not generate investment — they mostly generate increased stockholder dividends, executive bonuses, and stock buy-backs6, and

- the average hourly wage has not increased in spending power in forty years, and companies like Walmart pay poverty wages.

Lastly, while the average hourly wage has neither gained nor lost in spending power over the past four decades, the minimum wage has lost $2.29 per hour7, 24% of its purchasing power, yet there are those, Hassett included, who advocate that the minimum wage should not be raised.

It's misleading to project multinational corporation profit repatriation based on a 25-year-old study produced well before the acceleration and sophistication in keeping profits offshore, let alone corporate inversions — where a mere 20% ownership by a foreign company is enough to move headquarters abroad. And it's irresponsible to incur an additional $1.5 trillion in projected debt to fund tax cuts whose benefits will only worsen the economic divide. Working American will be standing at the end of the line, hoping for economic handouts, hoping any are left.

Read more

- Hungerford, Thomas L.. Corporate tax rates and economic growth since 1947, Economic Policy Institute, 4 June 2013. LINK

| 1, | Sachs, Jeffrey D.. Real Wages and Unemployment in the OECD Countries, The Brookings Institution. LINK |

| 3 | Adjusted for inflation, today's average hourly U.S. wage is no higher than it was four decades ago. The average hourly wage was $5/hour 40 years ago. That $5 is worth $21 today, meanwhile, the average hourly wage is now $22. |

| 4 | At the Center on Budget and Policy Priorities, Huang, Chye-ching et al. Corporate Tax Cuts Skew to Shareholders and CEOs, Not Workers as Administration Claims, Center on Budget and Policy Priorities, 16 August 2017. LINK |

| 5 | Peterson, Kristina. Report: Repatriation Tax Holiday a 'Failed' Policy, The Wall Street Journal, 10 October 2011. LINK |

| 6 | Goldman Sachs has estimated that S&P 500 companies would use three quarters of repatriated profits to repurchase stock. |

| 7 | Minimum wage of $7.25 today versus $2.30 in 1977 valued at $9.54 in 2017 dollars. |